Am I Diversified in the Age of AI?

Derek Beiter | Senior Investment Analyst

Last Updated: December 04, 2025

Artificial intelligence (AI) has been a powerful theme in markets, with investor enthusiasm bidding up share prices of companies expected to benefit from AI proliferation. Meanwhile, shares of companies perceived to be hurt by AI have generally declined. Over the past year, companies deemed AI leaders have returned 63.5%, while companies viewed at risk of AI disruption have returned -18.3%.1 Interestingly, not all companies expected to benefit from AI reside in the technology sector.

A popular investment television show with a charismatic host occasionally runs a segment called “Am I Diversified,” where callers phone in to ask the host whether a handful of stocks they own represent a well-diversified portfolio. I have a hypothetical one for readers today.

Suppose I own one stock from each of the following industries:

Semiconductors

Electrical equipment

Construction and engineering

Metals and mining

Specialized Real Estate Investment Trusts (REITs)

Electric utilities

Am I Diversified?

Maybe not. This may surprise some readers, since, at first glance, these six industries seem to represent distinct business types. However, certain stocks from these industries have become sensitive to AI proliferation. Scaling up AI requires a lot of computational power, which is often housed in data centers. Real estate firm CBRE estimates that construction of new data centers increased four-fold between 2021 and 2023 and continues to rise. Data centers have a variety of needs, including specialized technology, significant amounts of power, and specialized cooling for high-heat processes.

Some companies once viewed as stable and unspectacular have seen increased revenue from the AI data center buildout. As revenue increased, investors generally became more enthusiastic, bidding up share prices, while simultaneously increasing volatility, valuation risk, and correlations to the AI theme. Correlations are a way to statistically measure the degree to which two things move together. Correlations range from -1 to +1, with +1 implying that two investments move together precisely and -1 implying that two investments move in precisely opposite directions. In the “Correlations to AI Leaders” chart, we show the correlations of the aforementioned industries to the Goldman Sachs AI Leaders basket. Some of the correlations are strikingly high. It is obvious that the semiconductor industry would be highly correlated with AI proliferation, given its technological needs. Some readers may be surprised that construction and engineering companies are correlated with the AI theme. The high correlations may be due to the fact that certain companies are involved in the construction of data centers or the installation of their heating, ventilation, and air conditioning (HVAC).

Correlations to AI Leaders

Source: LPL Research, FactSet, Bloomberg, Goldman Sachs. Correlations shown are for the 156 weeks of data ending 11/21/25.

Disclosures: Past performance is no guarantee of future results.

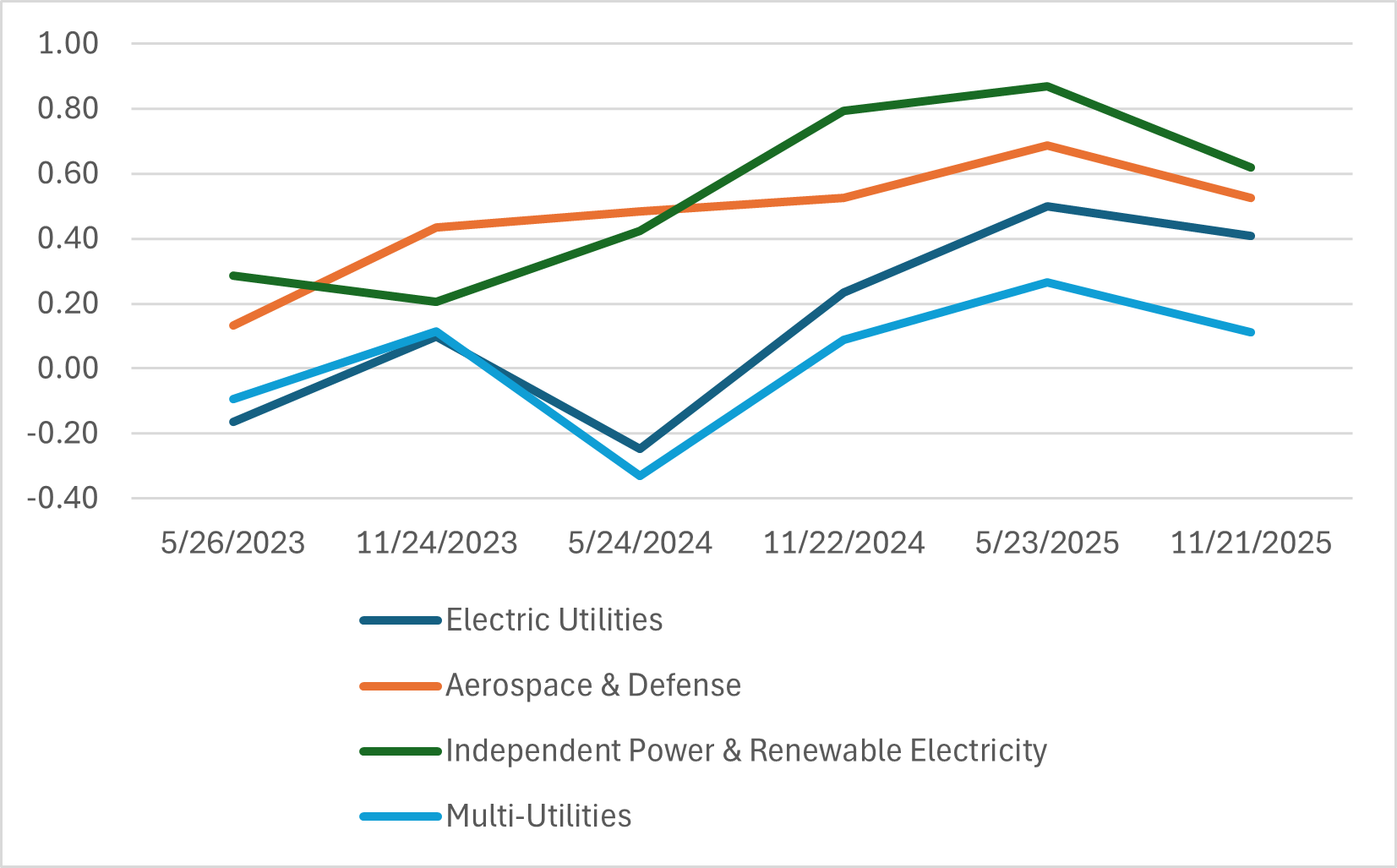

In the “Increasing Correlations to AI Leaders” chart, we plot the four industries with the highest increase in correlation to the AI Leaders basket over the last three years. Each plot on the chart represents a different 26-week period. Industries related to power and utilities account for three of the four largest correlation increases. This is important to note, given that utilities have historically been favored by investors seeking dividends and reliability. To the extent that some of these companies have become more dependent on AI, investors may experience more volatility going forward compared to the past.

Increasing Correlations to AI Leaders

Source: LPL Research, FactSet, Bloomberg, Goldman Sachs 11/21/25

Disclosures: Past performance is no guarantee of future results.

Important Differences Within Industries

There can be a lot of variety among companies in the same industry. In the case of metals and mining, specialized REITs, and electric utilities, these industries’ overall correlation to the AI theme is not particularly high, yet certain individual companies may show high or rising correlations to AI. For example, some mining companies mine for commodities used in data centers while others do not. Likewise, some companies in the specialized REIT industry own and lease data centers while others do not.

Does the AI Theme Impact Investors in Mutual Funds, Exchange-Traded Funds (ETFs), and Separately Managed Accounts (SMAs)?

Yes, investors in mutual funds, ETFs, and SMAs may want to review their portfolios for sensitivity to AI. Investors may be either over- or under-exposed to AI as compared to their risk profile and outlook for the theme. With the large discrepancy in returns for perceived AI winners and perceived AI losers, funds and SMAs are not immune to the impact of AI trends.

What Are Portfolio Managers Saying?

Talking directly with the portfolio managers of funds and SMAs is a big part of what we do on the Investment Manager Research team. In our recent discussions with managers, we heard a wide range of views on AI, ranging from skepticism to optimism. It does not necessarily cut cleanly along growth and value lines. One notable small cap value manager found dozens of companies benefiting from AI and purchased them early enough to justify the stock price valuations. A few days apart, we spoke with a different small cap value manager who was highly skeptical of AI. They noted a lack of share purchases (a key part of their process) by management teams at AI-related companies. They were also skeptical about how long the data center boom will last and whether the big AI players will diversify their suppliers, leaving some of the once-favored companies out of the mix. They also have concerns about whether the stocks’ valuations are appropriate. Growth-style managers also vary in their views on AI, with some enthusiastic about growth in revenue and earnings, while others are watching for increased competition among rival companies.

Key Takeaways

Many managers with a skeptical view of AI have had recent performance challenges relative to the benchmark indexes, as the AI theme has continued to perform well. That being said, one of my favorite sayings in investing is from portfolio manager Chris Davis, who is fond of saying that a portfolio is like a garden, if everything is in bloom all at once, everything can also stop blooming all at once.

Investors in actively managed funds and SMAs essentially delegate the day-to-day portfolio management to professionals constantly active in markets. The managers are typically making judgments about a company’s outlook and whether the share price is appropriate in light of that.

Our concluding point is that, if all of the investments you own are recently outperforming, it is possible they are over-exposed to the AI theme. Conversely, if all of your investments are currently underperforming, it is possible they are under-exposed to the AI theme. We believe it is important for investors to explore this — or better yet — consider working with LPL Research, whose professionals follow these trends and speak with investment managers regularly.

1 AI stock baskets sourced from Bloomberg, constructed by Goldman Sachs, and returns calculated by LPL Research for the 52 weeks ending 11/28/25.